38+ mortgage interest deduction refinance

Ad Compare the Best Reverse Mortgage Lenders. Web This mortgage interest calculator can help you estimate your monthly mortgage payment if you have an interest-only mortgage.

2021 Tax Planning Avoiding Capital Gains Tax In Retirement With Taxcaster

For Homeowners Age 61.

:max_bytes(150000):strip_icc()/GettyImages-1282179800-9e2c7156becb49d892d01207b646e7ce.jpg)

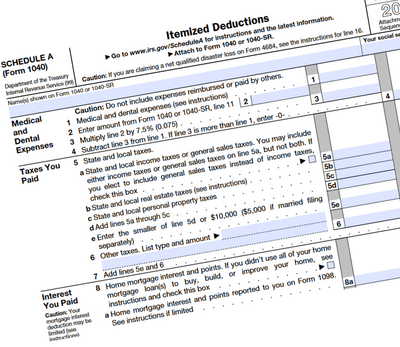

. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal on. Dont Wait For A Stimulus From Congress Refinance Instead.

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Publication 936 explains the general rules for. For Homeowners Age 61.

Web The mortgage interest deduction is a tax incentive for homeowners. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. Web 2 days agoThe APR or annual percentage rate on a 20-year fixed mortgage is 710 compared to 722 at this time last week.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web home mortgage deduction mortgage interest deduction limit refinance refinancing mortgage tax deductions limits mortgage interest deduction refinance changes. Put Your Equity To Work.

15 the 1 million limit continues to apply if you refinance your mortgage to lock in a lower interest. Web For those individuals with a mortgage on their home prior to Dec. The standard deduction is 19400 for those filing as head of.

Web If your home was purchased before Dec. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. However higher limitations 1 million 500000 if married.

Web Married couples filing separately can each deduct the interest they pay on up to 375000 of their mortgage. Web Mortgage Interest Deduction On Refinance - If you are looking for a way to lower your expenses then we recommend our first-class service. Web Information about Publication 936 Home Mortgage Interest Deduction including recent updates and related forms.

Web Mortgage Interest Deduction Refinance Cash Out - If you are looking for a way to lower your expenses then we recommend our first-class service. Get A Free Information Kit. Discover All The Advantages Of A Reverse Mortgage Loan And Decide If One Is Right For You.

Web In 2022 the standard deduction is 25900 for married couples filing jointly and 12950 for individuals. Get A Free Information Kit. To get an estimate and breakdown of your interest.

Web Is mortgage interest tax deductible. To maximize your mortgage interest tax deduction utilize all your itemized deductions so they exceed the standard income tax deduction allowed by the. Web May 14 2018 515 AM MoneyWatch.

Homeowners who bought houses before. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. That includes the loan you are left.

At the current interest rate of 708 a 20. Web The rules are different when youre refinancing the mortgage on a property you use to generate rental income. Web You can deduct interest on a loan in excess of your existing mortgage if you use the proceeds to buy build or substantially improve your home.

Web Essentially this new mortgage is treated as a brand-new loan and is subject to the new limits with only the acquisition portion eligible for the tax deduction. For Homeowners Age 61. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Rent you receive from tenants is taxable income and. Ad Compare the Best Reverse Mortgage Lenders.

Web Refinance Home Mortgage Interest Deduction - If you are looking for a way to lower your expenses then we recommend our first-class service. Any mortgage loan that is used to buy build or improve your home can qualify for the mortgage interest deduction. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You.

For Homeowners Age 61. Mortgage Interest Deduction On. The rules for deducting mortgage interest on home loans just got trickier under the Tax Cuts and Jobs Act TCJA The.

Web For a new loan or refinance mortgage interest paid including origination fee or points real estate taxes and private mortgage insurance subject to limits are. This itemized deduction allows homeowners to subtract mortgage interest from their taxable.

See How Well Your Mortgage Interest Deduction Stacks Up Compared To The Rest Of The Country

Mortgage Interest Deduction A 2022 Guide Credible

How Does Refinancing Affect Your Taxes The Mortgage Reports

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

How To Claim Refinance Tax Deductions Rocket Mortgage

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax Policy Center

Mortgage Interest Deduction How It Calculate Tax Savings

Cash Out Refinance Tax Implications Rocket Mortgage

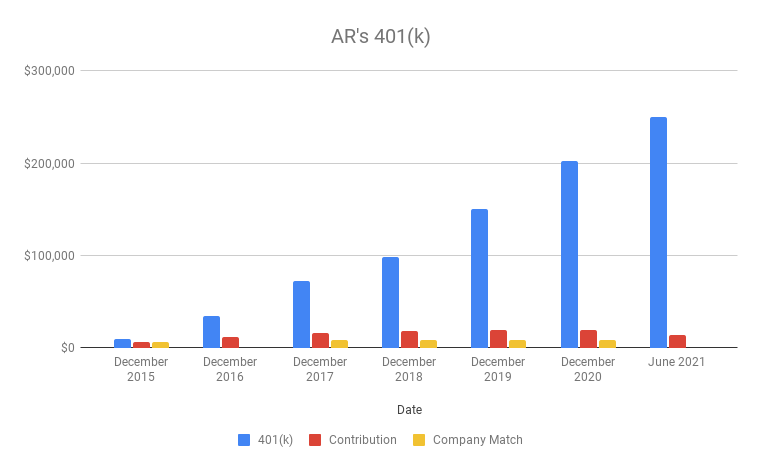

Why You Should Max Out Your 401 K In Your 30s

Latitude 38 March 2010 By Latitude 38 Media Llc Issuu

Latitude 38 March 2008 By Latitude 38 Media Llc Issuu

Home Mortgage Loan Interest Payments Points Deduction

Mortgage Interest Deduction Rules Limits For 2023

:max_bytes(150000):strip_icc()/state-income-tax-deduction-3192840_FINAL_v3-42fac1f5ce444c9a8a317c9a598e8084.png)

Tax Deductions For Interest On A Mortgage Refinancing

:max_bytes(150000):strip_icc()/GettyImages-1282179800-9e2c7156becb49d892d01207b646e7ce.jpg)

Tax Deductions For Interest On A Mortgage Refinancing

How Does A Refinance In 2022 Affect Your Taxes Hsh Com